In 2010 and invested heavily and under Marcello Lippi they won the 2013 AFC. China Evergrande Groups favored tactic to squeeze bearish speculators is to repurchase shares mopping up liquidity in the stock and driving up its price.

The stock had plunged 18 in the past month.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/FJQMAK52LRKOJIGPY73UXVBF4Y.png)

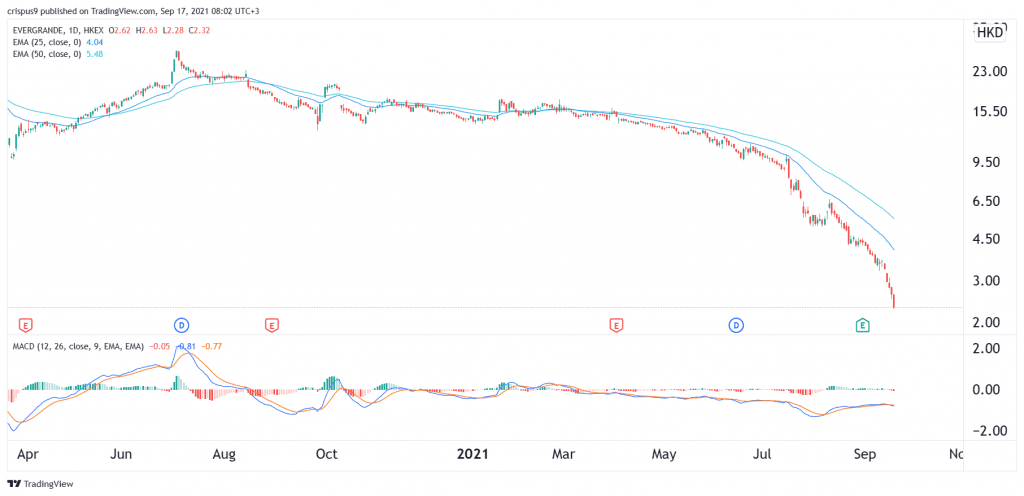

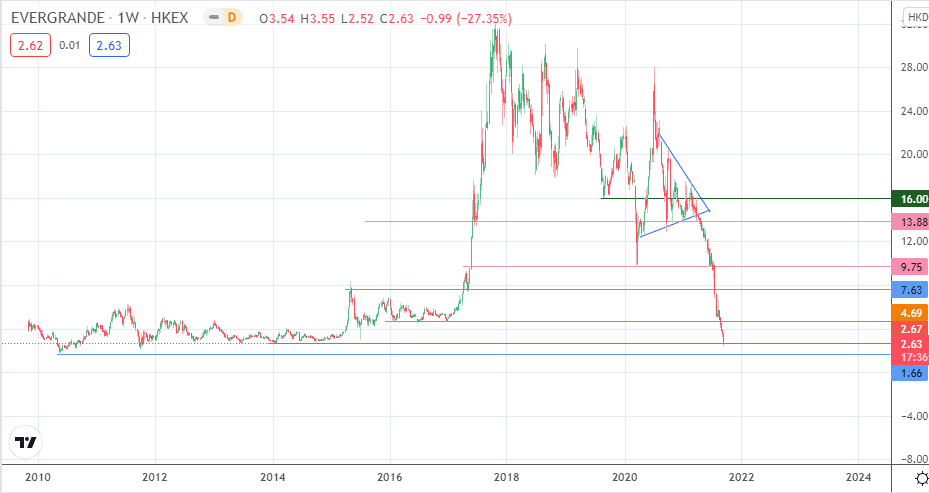

Evergrande stock price. The stock had plunged 18 in the past. Evergrande EV Stock Loses 80 Billion in Worlds Worst Rout Bloomberg -- Shares of China Evergrande Groups electric vehicle unit are collapsing in Hong Kong wiping about 80 billion from. Contracted sales increased by 20 in 2020 to CNY723 billion and by a further 5 yoy in 5M21 although the average selling price fell by 13 and 7 respectively.

Citation needed In October 2009 the company raised 722 million in an initial public offering on the Hong Kong Stock ExchangeThe group bought football club Guangzhou Evergrande FC. At any time and from time to time prior to April 11 2022 the Company may redeem up to 35 of the aggregate principal amount of the Notes with the Net Cash Proceeds of one or more sales of Common Stock of the Company in an Equity Offering at a redemption price of 1105 of the principal amount of the Notes redeemed plus accrued and unpaid interest if any to but not including the. Evergrande Billionaires Empire of Debt Downsized by Beijing Bloomberg News.

Evergrandes bonds have also tumbled. One reason may be that Evergrande shares have already been falling having lost 60 since their recent peak in. June 28 2021 1008 PM EDT Updated on June 29 2021 527 AM EDT Worlds most-indebted developer is now subject to.

Shares of Hong Kong-listed Evergrande jumped as much as 88 to an almost two-week high in afternoon trade versus a gain of 01 gain in the benchmark HSI. Regulators have been asking banks to conduct stress tests on Evergrande whose debt stood at 7165 billion yuan 111 billion at the end of 2020 making it the most indebted developer in the country. Bloombergs Rebecca Choong Wilkins reports on Bloomberg Daybreak.

Formerly called the Hengda Group Evergrande was founded by Xu Jiayin in the southern Chinese city of Guangzhou in 1996. Developer Evergrande Rises After Buying Back 43 Million in Stock - Companys shares gained 24 in Hong Kong trading after the announcement of repurchase but analysts say the volatility in the stock price is unlikely to ebb. HONG KONG Reuters - China Evergrande Group said on Tuesday its interest-bearing indebtedness has dropped to around 570 billion yuan 8823 billion from 7165 billion yuan at.

The theoretical value of an option is affected by a number of factors such as the underlying stock priceindex level strike price volatility interest rate dividend and time to expiry. The stock has lost 21 so far this year. The stock sank 13 per cent to HK978 at the close of trading on Wednesday erasing the equivalent of US19 billion from its market value.

The mid-price on its 21 billion yuan 5. Concerns about the health of China Evergrande Group have pushed its stock to close at the lowest since March of 2020. The stock is no longer Hong Kongs most shorted developer lagging behind the short interests in Country Garden Holdings Co.

The mid-price on its 21 billion yuan 58 October 2025 exchange-traded bond was last quoted at 64486 down from 65150 before the announcement according to Refinitiv data. Strong Sales Lower Selling Prices. The stock slipped to as low.

Unfortunately for the company and its billionaire founder that strategy is about to hit a wall. And Aoyuan Healthy Life Group Co according to data compiled by Bloomberg. A 12 per cent discount to Tuesdays closing price.

Evergrande Property Services Group slumped in Hong Kong by the most since its December listing after an unidentified seller offloaded several blocks of shares as soon as a six-month lock-up period on key investors expired on Wednesday. Evergrandes shares and some of its bonds have been sold off in recent weeks amid growing investor concerns over its ability to make timely payments. China Evergrande Groups Riverside Mansion project on the eastern bank of the Huangpu River in Shanghai.

We expect Evergrandes EBITDA margin excluding capitalised interest to drop to around 19 in 2021-2022 from 22 in 2020 and 25 in 2019. Shares of Hong Kong-listed Evergrande jumped as much as 88 to an almost two-week high in afternoon trade versus a gain of 01 gain in the benchmark. The companys dollar note due 2025 rose 05 cents on the dollar to 739 cents paring some losses after falling to an eight-month low the.

The mid price on the companys 134 billion June 2023 bond was last quoted at 80625 cents according to Refinitiv down from a recent peak of 9175 on May 26. More This calculator can be used to compute the theoretical value of an option or warrant by inputting different variables. The stock has tumbled 58 per cent from a peak last July.

What Is China Evergrande And Why Is It In Trouble The Washington Post